Hi

After reading the hardcore theses on NFTs in the last few issues, I’m guessing the big question in your head now should be…

“Why not just tell me what NFTs to buy?”

Unfortunately, there isn’t such a straight-forward answer when you’re investing in NFTs (If you’re buying an NFT for fun, that’s an exception. You can just buy whatever you like).

But if you want something that can retain its value or even appreciate.

It’s important to study the NFT space very carefully because rugpulls are extremely common.

There are roughly two classes of NFT buyers right now:

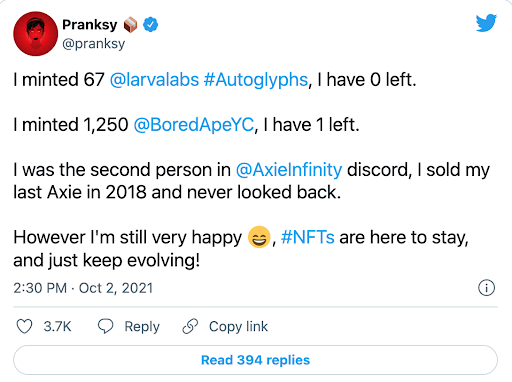

- The Flippers (Traders).

- The Hodlers (Investors)

Honestly, I’m more of a HODLer because my approach is to buy promising projects and hodl for the long term because it’s extremely difficult to flip (I’ll explain why in a moment).

For NFT Flippers, they tend to find the most promising and most hyped projects that everyone else is likely to buy into, and then use bots, scripts and ninja reflexes to mint those projects before everyone else, and then quickly flip them.

For Hodlers, they tend to buy undervalued NFTs at a discount from the secondary market (Opensea) and hold for the long term appreciation (multi-year time horizon) as the project grows.

Both are great strategies and people from both sides of the camp have made money so it really depends on your personality and also the amount of time you’re willing to watch the NFT market.

You can get a life-changing amount of money from flipping if you’re lucky (and skilful) but it also does take a lot from you.

Life as a NFT flipper revolves around Discords as you’ll need to get access to Whitelist slots in order to mint projects first hand.

The best flippers also use pro tools like Nansen.ai, icy.tools, RaritySniffer, rarity.tools and rarity.guide to carefully track data and analytics.

These tools are able to give them an unfair advantage on knowing what projects are about to blow up.

Apart from minting, these Flippers also have to identify buying opportunities on the secondary market like Opensea and Rarible so as to be able to flip NFTs for a massive profit as certain projects continue to grow.

On the other hand, hodlers look at:

- Promising projects which have a long term vision and hence greater value.

- Capable, credible and doxxed Founders (E.g. Gary Vaynerchuk and Bobby Hundreds)

- Quality Community (And not just a community that’s fixated on the floor price)

- Price point of the NFT

Here’s a longer explanation of how to find quality NFT projects: (according to Ben Yu. I’ll be added a personal commentary below according to my very own understanding of Ben’s statements since he tends to write in a more prose-like manner)

Question: What kinds of projects might stand the test of time?

Ben Yu: First and foremost, find projects that have incredibly strong, resilient communities behind them that grow in organic ways and stick around for much more than just the money — the precise paradox of things is that the communities that form not for the money (or at least not solely for the money) but for other reasons are precisely those that are likely to be worth the most money in the end, just like CryptoPunks.

Because they’ll weather the inevitable downturns of the mercurial and capricious crypto and NFT markets far better than other projects.

Commentary: Community needs to have intangible value and not just be talking about the floor price all day.

Ben Yu: A project where everyone is in it just for the money will grow tremendously faster than other projects when the price is going up, as the price itself increasing is the primary draw which brings all the fish in the speculator swarm to feast.

At the same time, as soon as the price begins to falter, as it inevitably will at some point, all the speculators will rush to the exits to not be the last fool standing holding all the bags, as there’s nothing else keeping them around besides the price, and thus when the price goes away, so too much all the speculators, in the most rapid and least orderly fashion possible.

Commentary : Be wary of projects which have a lot of Hype like Phantabear or Invisible Friends.

Projects which grow too quickly also have the equal risk of declining quickly too.

Personally, I do not buy NFTs if I don’t have the intention of holding it for the long term.

Ben Yu: A project where everyone isn’t in it for just the money, but rather is in it for the community and whatever the community is building, is one where even when the bottom falls out in the market and the price craters, members will refuse to sell, and will in fact continue to grow and build on the project.

When the tide flows back in and prices and demand begin to rise again, this project will be leaps and bounds ahead of all the other projects that were skinned to their bones and left as skeletons without a community when the tide last washed out.

When that happens, the most obvious project for everyone to rally behind will be the project that kept growing even when there was no financial incentive behind it — and no other project will really stand a chance of catching up, having abandoned the ecosystem in the downturn.

Commentary: Projects that have the highest probability of survival in a bear market tend to have passionate communities in which members are bounded together for the long haul towards a common goal and they’re not just incentivized by pure profit.

These projects tend to have a higher % of hodlers rather than flippers.

Conversely, you will see a higher % of flippers rather than hodlers in a project which has generated a lot of hype. (Invisible Frenz, Phantabear, HAPE Beast)

Ben Yu: So yeah — identifying the projects that will stand the test of time is incredibly difficult to do in a bubbly bull market with so much hype, because oftentimes the best projects with long term horizons and invested communities can look quite similar to the projects with teams that are just in it for a quick money grab and communities that are here for the same.

You really need to dig deep and spend time in each community to suss out the differences, and that’s not something you can do at a quick glance — it takes time and investment.

Commentary: Do your own research.

Be wary of irrational exuberance in a bull market where prices are generally high all over.

However, many of these bad NFT projects will die out in a bear market, and it will be a fantastic timing for all of us to buy high-quality NFTs at a much cheaper price.

Ben Yu: In short, the best way to determine what things are likely here to stay is to see how you yourself feel about them — if you find a community you love and a project you want to invest in for more than just the promise of quick riches, and you have confidence that even if the price of your asset falls 90% or more (when you’ve been in crypto as long as I have, you know that’s not an exaggeration in the slightest— I’ve been holding Ethereum since $7, and saw it rise to over $1400 in 2017 to fall down more than 90% to $100 in 2019, to come back up now to over $3400–there’s no reason NFTs won’t be the same), you yourself won’t sell, and you see that others feel the same way…well, then that’s a pretty damn good sign.

Commentary:

Do not invest heavily until you have experienced the project or community yourself first-hand. Also, do not get lured in by the promise of quick riches because it makes you think extremely short term.

The core tenet of choosing undervalued and promising NFTs is having a long term perspective. A high-quality community needs a significant amount of time and investment to build.

Hence, do not expect quick riches when buying NFTs for the long term (unless you’re buying to flip which is a totally different ball game).

In conclusion, I hope Ben’s analysis (and my commentary) paints a clearer picture for you.

In case you’re wondering why I haven’t answered the question on “What NFTs should I buy?”

That’s because everyone’s time horizon, personality and risk appetite is different.

Because of that, I’ll share the basic tips on what to look out for in a good project rather than just telling you directly what projects to buy.

That said, I very, very strongly do not want to take the responsibility of suggesting anything for anyone to invest in in this space.

The NFT space is even earlier right now than 2018 was for crypto, and this field is always ever-changing and I’m certain there will be many twists and turns which I can’t fully predict.

If you’re in your mid 30s and 40s with bills to pay, a family to feed and you can’t really afford losing money then I’d recommend that you avoid NFTs altogether (unless you understand and believe in the technology and project).

However, if you have some spare cash and you’re wondering about how this disruptive technology is gonna work and whether it’s overhyped…

I’ll recommend you to dip your toes in a little bit.

If you’re a younger reader (and you have time on your side), I’d even recommend you to study the technology behind NFTs because it will change people and communities just like the Internet (Web 1.0) and Social Media (Web 2.0) did.

That said, there’s a good chance that 95% of NFT/Blockchain/DeFi projects will go to zero so do the necessary diligence before you invest any money.

That’s it for me and my 4-Part NFT series on WYODC Weekly.

I hope you’ve learned something from it.

Cheers,

Zach